The convergence of two groundbreaking technologies is reshaping how we think about AI, automation, and intelligent systems, affecting every industry...

Transitioning Web 3.0 | Artificial Intelligence | XR Smart Technology

(Warning: got me some strong opinions here…) 😆

The thing that blows my mind most over the FTX scandal is that all of the huge traditional finance investors, like Sequoia Capital, with their back room deals, couldn’t possibly have done one ounce of due diligence with FTX. To me this whole entire situation blatantly displays as corporate greed in its finest, and traditional finance fraud. If there’s enough money on the table, they all turn a blind eye.

The FTX bankruptcy filing was made public day a few days ago, and it’s effing mind blowing:

According to Milk Road after pouring through the BK filing:

“💬 FTX had no cash management or employee record system. Aka they never knew how much cash or how many employees they had

💬 Managers accepted employees expenses with EMOJIS. Yup, these things 🤪

💬 FTX didn’t have an accountant or keep proper records of customer deposits. Oh, and they also used software to conceal the misuse of customer funds

💬 Not only did Samuel receive more than $1b from FTX, but Director of Engineering, Nishad Singh, also received a $543 million personal loan

💬 FTX never had board meetings

💬 FTX built a “secret exemption” so that Alameda could avoid the auto-liquidation protocol on the app. Alameda was in god mode.” …..

Crazy that they used software to conceal the misuse of customer funds, but couldn’t be bothered to use software to keep proper records. 🤣😳

More than 80 investors poured almost $2 Billion into the FTX startup over 2 years.

Just who are these investment firms that simply threw money at Sam Bankrun Fraud with no due diligence, AGREEING TO his stipulation of “little to no oversight?

Some notable players:

NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield, Insight Partners, Sequoia Capital, SoftBank, Fortress, Fidelity, Paradigm, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings, BlackRock and Thoma Bravo …

And with situations like Sequoia where they invested in FTX, and in turn Alameda (the shell owned and run by Sam that was funneling billions of customer money out of FTX) invested funds back into Sequoia… it seems to me the investors got an instant return on the backend and a boatload of profit on the front end while FTX was pumping. (Sequoia reportedly invested $210 million in FTX, in return for hundreds of millions invested back into Sequoia by Alameda, AND they made money on the front end of their initial investment while things were hot.)

It’s crazy that people who don’t know any better look at this and say crypto is the problem. The only problem here is these centralized organizations with their corporate greed and self-interest. The fact that a crypto exchange platform could be run by one singular greedy mofo and his tight little band of miscreants, playing God with everybody’s money, um… that’s exactly why we need self-custody and decentralization. … Decentralized crypto and Decentralized exchanges (DEX) are literally the only way forward.

And this week, DEX trading volume was up by 151% with over $31 Billion in total volume.

AND in the past 30 days, over 110k Bitcoins were moved to self-custody wallets.

Seriously, for as much as politicians and the US government is trying to push for regulation that gives them all the control and disallows (even criminalizes) self-custody, this FTX scandal and their involvement in it (with all the millions in political donations and Sam’s tight involvement with the SEC selling out our protected rights) just made a glorious case for why self-custody and decentralization is necessary for anti-corruption – yes, even government corruption, and it’s a freedom we need to fight for and protect.

Okay, I think that’s all. LoL

(Mic drop 🎤)

All content on this site is independently created by Denise Holt. If you enjoy this content, please consider supporting my efforts at patreon.com/SpatialWebAI

The convergence of two groundbreaking technologies is reshaping how we think about AI, automation, and intelligent systems, affecting every industry...

On 29 May 2025, the IEEE Standards Board cast the final vote that transformed P2874 into the official IEEE 2874–2025...

Explore the future of agent communication protocols like MCP, ACP, A2A, and ANP in the age of the Spatial Web...

Fusing neurons with silicon chips might sound like science fiction, but for Cortical Labs, it represents what's possible in AI...

Ten years ago, on March 31, 2015, I interviewed Katryna Dow, CEO and Founder of Meeco, to discuss an emerging...

We stand at a critical juncture in AI that few truly understand. LLMs can automate tasks but lack true agency....

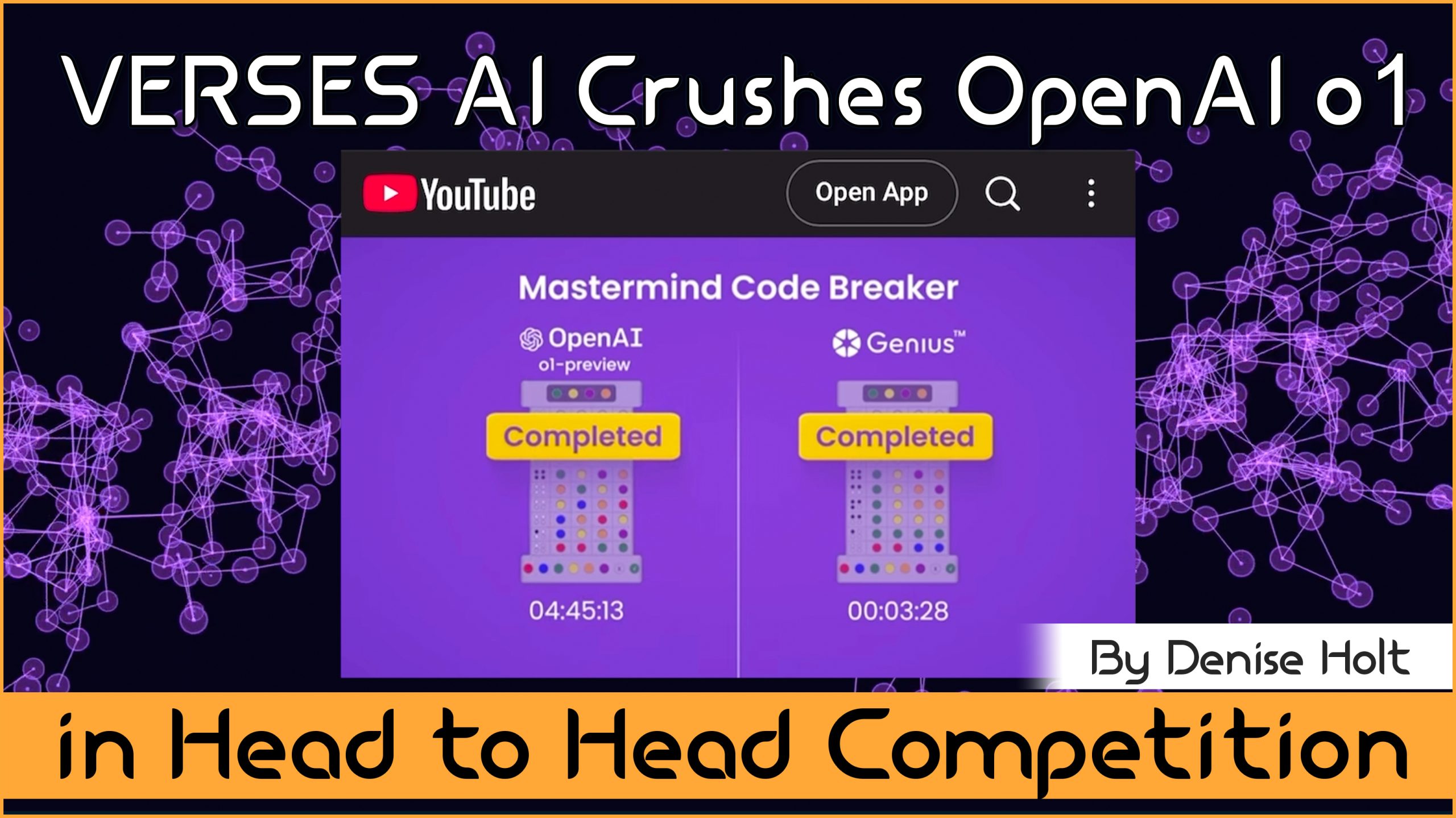

VERSES AI 's New Genius™ Platform Delivers Far More Performance than Open AI's Most Advanced Model at a Fraction of...

Go behind the scenes of Genius —with probabilistic models, explainable and self-organizing AI, able to reason, plan and adapt under...

By understanding and adopting Active Inference AI, enterprises can overcome the limitations of deep learning models, unlocking smarter, more responsive,...